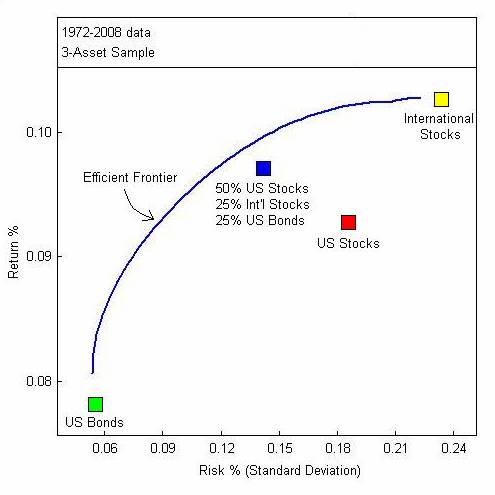

Modern Portfolio theory invented by Harry Markowitz in 1952 is used by portfolio managers to aid asset allocation decisions by constructing portfolios to optimize expected return based on a level of expected market risk. The theory constructs an "efficient frontier" offering possible expected return for a given level of risk. This theory is applied by most financial advisors and portfolio managers. The allocation targets used by most wealth managers, robo-advisors and portfolio managers utilize these theory to determine portfolio construction. This theory is very attractive because of its simplicity. The complexity of investor goals and objectives are converted to expected risk and return statistics which make application quite easy.

Is this the best way to go? Sometimes easy and simple solutions work and should be followed. Other times they are too dangerous and need to be ignored. And then there are times when simple solutions should be followed to provide starting point but with a thorough understanding of the flaws the final solution can be created. As I develop asset allocation models for my clients I develop them with a clear understanding of the limitations of Modern Portfolio theory and create safeguards that will help the client create opportunities while controlling risk.

The construction of a portfolio using Modern Portfolio Theory rests on many inputs and assumptions. First the return and volatility inputs that are used need to be accurate. For the sake of convenience many managers use historical data for these input parameters as forecasting data is difficult. The applicability of historical data can be suspect as we have seen shifts in our lifetimes. Second, there is an assumption by the theory that financial markets are efficient. I will not debate this pro or false but I would say that they are not always efficient. There are times where we have experienced major dislocations in efficiency. Third, there is an assumption that participants in financial markets and investors are rational. This is another hotly debated topic. I you don't doubt this point consider election day 2016: When Trump was expected to win the market had an enormous down move but then buyers came in and started the big rally. Rational or not I would also say that it is not consistent. Fourth the theory assumes that financial transactions occur without cost or very little cost. The cost of transactions (borrowing, lending, trading, etc...) we have seen is often expensive based on bid ask spreads of securities and based on costs charged by intermediaries. There is also a lack of consistency in this assumption. Fifth in application of Modern Portfolio Theory there is a difference in utilizing more and less asset classes and how they behave with each other. Because of the relationships within different asset classes you have instances where portfolios designed are much different then optimal portfolio that the theory recommends. Sixth, Modern Portfolio Theory assumes asset prices behave "normally" as they have normal distributions. In reality we have seen that asset prices don't behave with a normal distribution. At times the tails are very fat and that means the likelihood of distorted events is a lot greater.

There is value to work with a portfolio manager that will protect you and your portfolio by understanding the flaws in the Modern Portfolio Theory. We would be happy to talk with you about your portfolio.